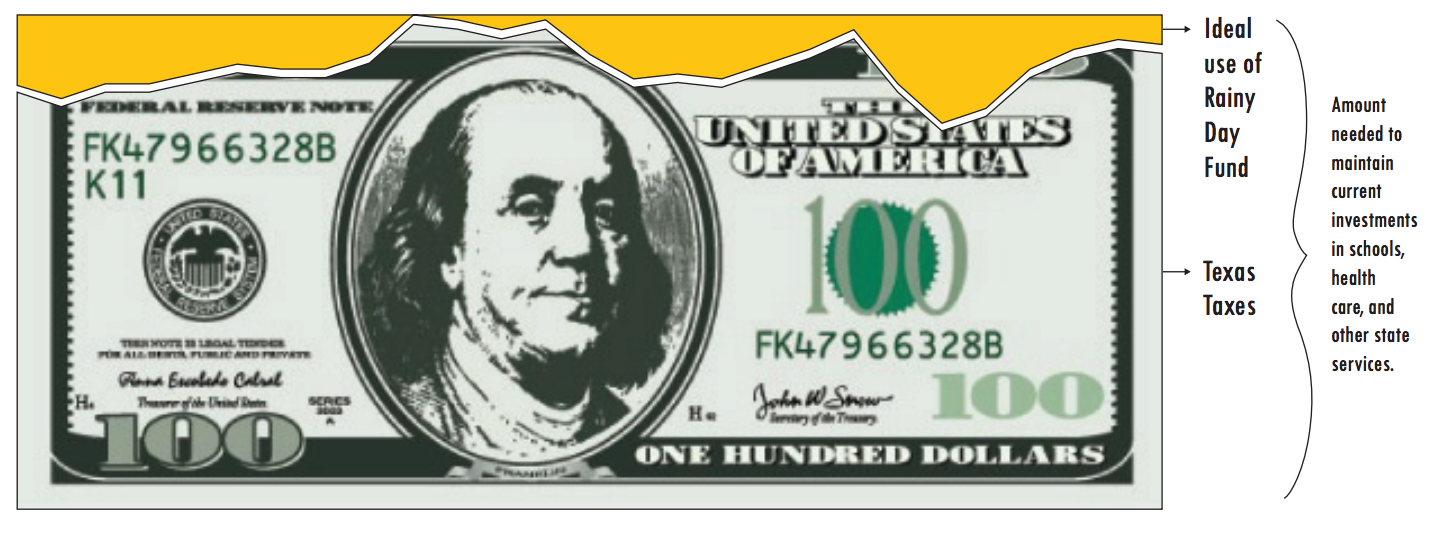

Everyone fortunate enough to have a savings account knows it’s a blessing during hard times. Texas is fortunate to have a large savings account in its Rainy Day Fund, created to prevent or reduce sudden massive cuts to schools, health care and other state services. Short-sighted tax cuts and diversions in recent legislative sessions mean that lawmakers have reduced General Revenue available to write the next state budget by at least $10.5 billion — independent of the drop in oil and gas prices. It’s too early in the state budget cycle to make any meaningful economic and state revenue forecasts through August 2019, but a clear understanding of the Fund is helpful at any stage of the budget process. Ideological arguments for not spending any of the Fund should not prevent state leaders from tapping the account if needed to maintain state services in 2018 and 2019.

Since 1989, the State Constitution has required that a portion of oil and gas production taxes go into the Economic Stabilization Fund (ESF), more commonly known as the Rainy Day Fund. Many states have a cash reserve, but Texas has the largest in the country. With a supermajority vote, the legislature can also use the Rainy Day Fund as general revenue in the current or next budget cycle. The Texas Constitution authorizes the Comptroller to make temporary transfers out of the Fund to make up for a General Revenue deficit.

The Fund receives a transfer of at least one-half of 75 percent of the prior year’s oil and gas severance tax collections that exceed what each of those taxes generated in 1987. Starting with fiscal year 2015, the remainder of that 75 percent goes to the State Highway Fund. Before 2015 the Fund received all of the transfer.

The Fund balance was $9.6 billion after the November 2015 transfer—a record high. Natural gas tax deposits were a major source of revenue growth for the Fund from 2006 to 2009; oil severance taxes were more important from 2013 to 2015.

Transfers to the Rainy Day Fund are required when any uncommitted General Revenue remains at the end of a biennium. That has happened twice: $20 million in 2001 and $1.8 billion in 2008. Interest generated by the balance stays in the Fund as long as doing so doesn’t put the fund over its cap. The Legislature can also appropriate money to the Fund but has never done so.

The Constitution limits how big the Rainy Day Fund can become. The cap is 10 percent of revenues deposited in General Revenue in the prior 2-year period, excluding interest and investment income and fund transfers but including some federal revenue. The current cap is $16.2 billion.

State law requires the Legislature to establish a minimum balance for the Fund each biennium. This “sufficient balance” is set at $7 billion for 2016-17. The balance requirement was created in response to fears that too small a fund would hurt the state’s credit rating. But in the early 2000s, before the sufficient balance requirement existed, the Fund balance dropped to almost zero, with no harm done to the state’s credit ratings. As the State Comptroller recently noted, “An ESF balance provides a flexible alternative, in addition to budgetary and revenue tools, to manage through challenging economic cycles. An ESF balance demonstrates fiscal strength and flexibility, but balances are not the only factor rating agencies consider.”

Though use of the Fund has recently become a point of contention, the Legislature has used the Fund frequently, for both one-time and ongoing budget items. Legislative approval by a two-thirds vote in the House and Senate is required to spend money from the Fund in most circumstances.

In the past, the Legislature has spent the Fund on everything from public schools to criminal justice to closing shortfalls in Medicaid and the Children’s Health Insurance Program. The Fund has been used for new budget items such as the State Water Plan or the Texas Enterprise Fund.

The following are common-sense situations when legislators should consider using the Day Fund:

The Rainy Day Fund is not designed to correct chronic underfunding of state services. If something needs additional funding in general then the Legislature should devise a way to provide permanent, additional funding.

Copyright © Center for Public Policy Priorities. All rights reserved.